Created in 2007 by the Pennsylvania Office of Child Development and Early Learning (OCDEL), The Pennsylvania Key implements the work and supports the policies developed and managed by OCDEL. Learn More. >

Created in 2007 by the Pennsylvania Office of Child Development and Early Learning (OCDEL), The Pennsylvania Key implements the work and supports the policies developed and managed by OCDEL. Learn More. > Created in 2007 by the Pennsylvania Office of Child Development and Early Learning (OCDEL), The Pennsylvania Key implements the work and supports the policies developed and managed by OCDEL. Learn More. >

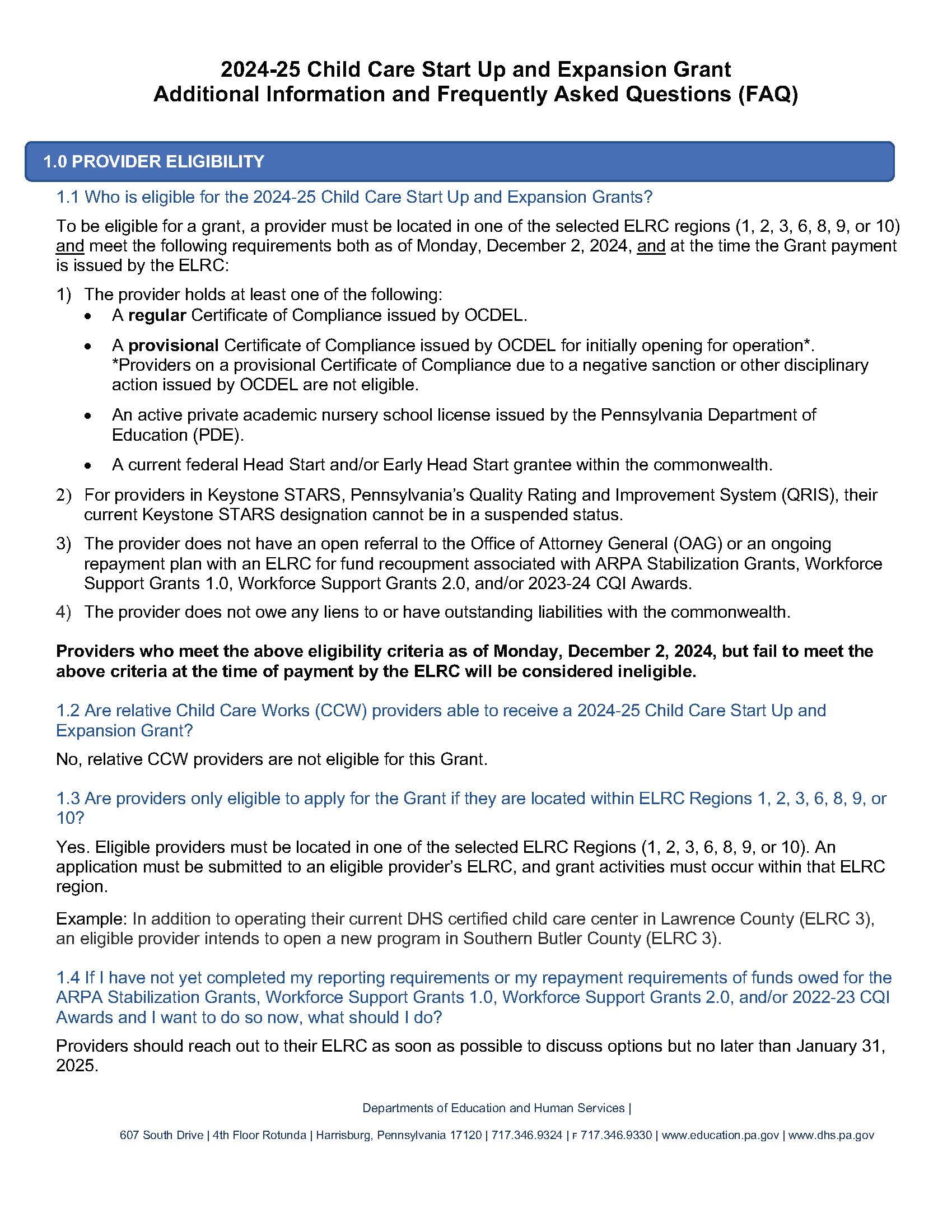

Created in 2007 by the Pennsylvania Office of Child Development and Early Learning (OCDEL), The Pennsylvania Key implements the work and supports the policies developed and managed by OCDEL. Learn More. >To be eligible for a grant, a provider must be located in one of the selected ELRC regions (1, 2, 3, 6, 8, 9, or 10) and meet the following requirements both as of Monday, December 2, 2024, and at the time the Grant payment is issued by the ELRC:

Providers who meet the above eligibility criteria as of Monday, December 2, 2024, but fail to meet the above criteria at the time of payment by the ELRC will be considered ineligible.

No, relative CCW providers are not eligible for this Grant.

Yes. Eligible providers must be located in one of the selected ELRC Regions (1, 2, 3, 6, 8, 9, or 10). An application must be submitted to an eligible provider’s ELRC, and grant activities must occur within that ELRC region.

Example: In addition to operating their current DHS certified child care center in Lawrence County (ELRC 3), an eligible provider intends to open a new program in Southern Butler County (ELRC 3).

Providers should reach out to their ELRC as soon as possible to discuss options but no later than January 31, 2025.

Tax Clearance Certificates should be available through the PA Department of Revenue or at the provider’s County Prothonotary Office and then presented to the ELRC to demonstrate fulfillment on or before January 31, 2025.

No, your program is not eligible as you currently do not hold a regular Certificate of Compliance from OCDEL Certification on December 2, 2024. The only instance in which a program on a provisional Certificate of Compliance is eligible to apply for this grant is if the certificate is an initial provisional issued to newly opened programs.

No, the Child Care Start Up and Expansion Grant amount is not affected by an eligible program’s STAR level.

Yes, if your program meets all other eligibility criteria at time of application and at time of grant payment by the ELRC, you are eligible to apply for a Child Care Start Up and Expansion Grant.

Yes, if the program holds at least one of the following and meets all other eligibility criteria:

Yes, PA PKC providers are eligible for a Child Care Start Up and Expansion Grant if they meet one of the following PA PKC provider types:

PA PKC programs that are operated by a School District are not eligible for the grant.

Eligible providers who are interested in applying for a Child Care Start Up and Expansion Grant must complete a grant application and submit to their ELRC no later than Friday, January 31, 2025. Applications received after January 31, 2025, will be considered ineligible.

For reference, a copy of the Child Care Start Up and Expansion Grant application is available at pakeys.org/startup-application.

Yes, an electronic signature is acceptable when completing and signing the Child Care Start Up and Expansion Grant application.

Beginning December 5, 2024, providers who have questions about their eligibility to apply for a Start Up and Expansion Grant should contact their ELRC. ELRC contact information can be found at pakeys.org/startup-submission.

Yes, the following documents will be available in Spanish:

Providers can look to the following resources for help in finding their FEIN:

Providers can look to the following resources for help in finding their MPI:

NOTE: Head Start programs and Private Academic Licensed Nursery Schools may not have an assigned MPI number. These providers should complete the application specifically designated for their provider type which does not require a MPI number.

Yes. Providers may rescind their signed application for a Start Up or Expansion Grant by contacting their ELRC as soon as possible.

Providers who have executed their Grant Agreement and later wish to rescind their acceptance should contact their ELRC as soon as possible.

Providers who have already received grant funding and wish to return all or part of the amount may do so by contacting their ELRC for further instructions.

If the ELRC has not yet made payment when the ‘Revocation or Refuse to Renew’ status has been declared by OCDEL-Certification, the provider will be found ineligible and will not receive grant funds.

No, providers cannot make changes to an application once it has been submitted to their ELRC. ELRCs will begin reviewing applications as soon as they are received and therefore cannot accommodate changes to applications.

The term application submission date is the date the ELRC receives the Child Care Start Up and Expansion Grant application via email, fax, or via USPS as validated with a postmark. It is NOT the date that a provider signs the application.

Example: ABC Child Care completes and signs their Child Care Start Up and Expansion Grant application on December 12, 2024. They email the application to the ELRC on December 14, 2024. The application submission date for ABC Child Care will be considered December 14, 2024.

Example: 123 Child Care completes and signs their Child Care Start Up and Expansion Grant application on December 30, 2024. They place their grant application letter in the mail (USPS) on January 2, 2025. The letter is postmarked January 4, 2025, by the USPS. The application is received by the ELRC on January 6, 2025. The application submission date for 123 Child Care will be considered as January 4, 2025.

Yes, large legal entities with existing programs within the selected ELRC regions can apply for Child Care Start Up and Expansion Grants (Type 3 -Start Up Grants). In this case, the Large Legal Entity Administrator would complete two applications using information from two of their five current locations within ELRC 9.

Yes, Head Start grantees can apply for a Type 1 Conversion Grant for each eligible location in the selected ELRC region (1, 2, 3, 6, 8, 9, and 10). In this case, the Head Start grantee would submit two separate applications to ELRC 6; one for each location.

No, providers will not need to relinquish their Head Start and/or PDE nursery school programming. The intent of the grant is to include certified child care in their current programming.

Providers are required to provide a detailed summary of their plan to utilize grant funding. Applicants should include specific information about each of the following in their Project Overview, if applicable:

Example #1 (Detailed, well-written Project Overview): Our program, ABC Child Care is applying for a Type 2 Expansion Grant. A recent survey conducted by the Chamber of Commerce revealed that families are struggling with finding affordable care for young children. With grant funding, we aim to enhance our current offerings and address unmet needs of our community by creating two additional classrooms and purchasing necessary supplies. We will use $10,000 for Minor Renovations, which includes repainting classrooms, upgrading restrooms for accessibility, and enhancing outdoor play areas to better accommodate our growing number of children. We plan to allocate $5,000 towards Materials and Equipment for age-appropriate educational materials and supplies, including books, art supplies, and STEM kits. Finally, we plan to use $4,300 in Personnel Costs which will support us in hiring 2 new teaching staff, offering each a $2,000 sign-on bonus, and covering their required clearances. We will work with the local community college to identify recent ECE major graduates and/or students who will be graduating soon. Ongoing, we hope to partner with other community agencies to foster partnerships to secure additional funding and resources, including sponsorships for events and programs.

Example #2 (Project Overview that lacks details and clarity): Our program, ABC Child Care, is requesting $20,000 in grant funds. We hope to increase our licensed capacity and will use the funds to support this activity. We hope to hire new staff and buy materials.

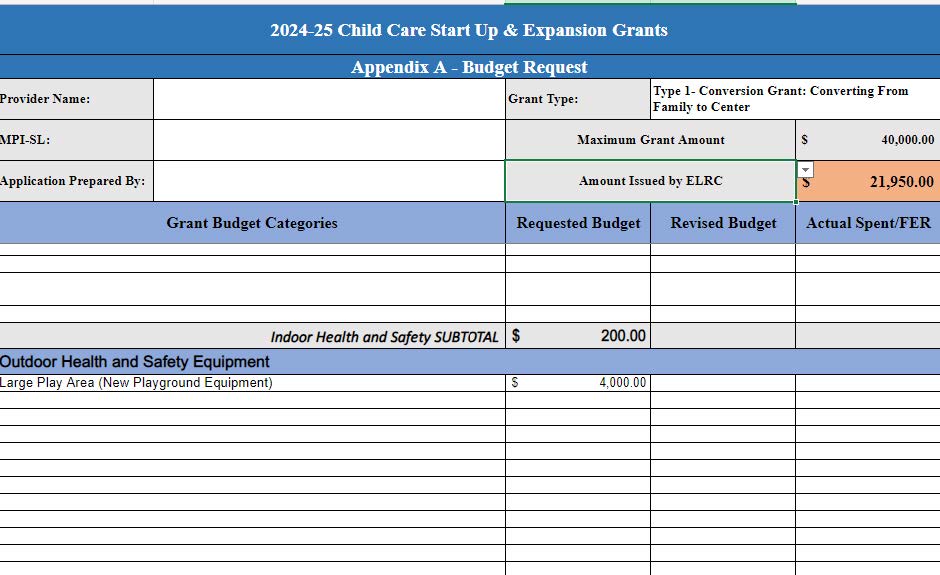

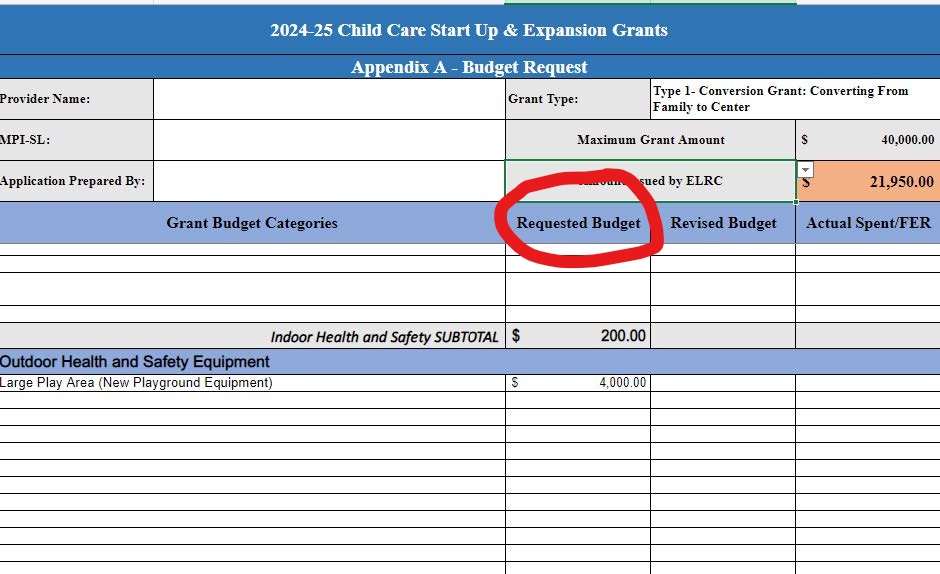

Providers must use Appendix A: Budget to complete their Requested Budget, listing expenses appropriately by category and ensuring total expenses do not exceed the amount of grant funding. Providers will complete the Column labeled Requested Budget and sign Appendix A: Budget in the appropriate signature section. The screenshot below shows a portion of Appendix A: Budget with the Requested Budget column circled.

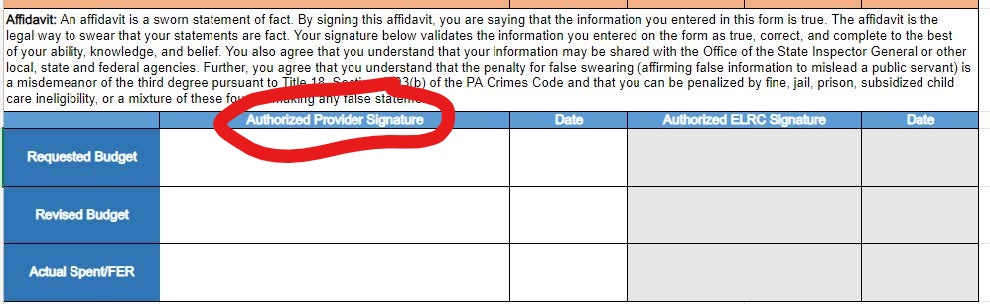

The screenshot below shows the signature portion of Appendix A: Budget that will need to be signed by a provider when submitting Appendix A as part of their application.

No, providers must use Appendix A: Budget to submit their Requested Budget as part of their application. Budgets submitted on formats other than Appendix A: Budget will receive a score of 0 in Section 5: Budget of the Scoring Rubric.

No, ongoing operating expenses are not an eligible expense category for this grant.

Federally approved and/or corporate indirect cost rates assessed to affiliated programs are not permissible for the Grant.

No. Start Up and Expansion Grant funds can only be used for eligible expenses incurred between July 1, 2024, and May 30, 2025.

Non-traditional care is defined as care provided from 6 pm through 6 am on weekdays (Monday through Friday) and any time on weekends. Grant funds could be used for eligible expenses incurred by a provider in offering non-traditional care.

The following are some examples of how this program could use grant funding:

Yes, providers must obtain a minimum of two qualified comparative written price quotes or estimates for any single purchase with an estimated cost of $5,000 or greater. The price quotes must be maintained on file by the provider. In the event a provider chooses not to select the lowest price quote, the provider must create a written justification and maintain this justification with their records for audit purposes.

Providers have significant flexibility in structuring their Requested Budget as part of their application. They can either group similar expenditures into a single line item for use across different classrooms or program areas (e.g., Safety – smoke detectors, carbon monoxide detectors, security cameras) or organize the budget by the specific classroom(s) that will benefit from the grant. Providers should not list individual items as separate line items (i.e. box of crayons, construction paper) unless they are large in scale (i.e. handwashing station). Instead, items that are similar should be grouped together as a single line item to minimize the need for Revised Budgets. In the example above, the box of crayons and construction paper could be included in a more general line item of “Consumables” under the “Materials and Supplies” grant category.

The following examples illustrate how line items can be grouped together.

Example #1: In the following screenshot, the provider has grouped several items together as a single line item for Classroom #1 (Door locks, cabinet locks, etc.) rather than listing each item as a separate line item for Classroom #1.

Example #2: In the following screenshot, the provider has grouped all Flooring Upgrades together as a single line item even though they will be used in 3 different classrooms. In addition, the provider has grouped drywall installation and painting together as a single line item even though they will be used in 2 different classrooms.

Example #3: In the following screenshot, it should be noted that the line items are fairly broad in nature. For example, there is a single line item for all learning activity toys rather than listing each type of learning activity toy as single line items. Similarly, the provider listed all Consumables as a single line item (construction paper, crayons, paint) rather than listing each type of consumable as a single line item.

Providers who receive a grant and need additional funding can submit a Revised Budget to their ELRC. The additional funds requested (plus the original grant amount) cannot exceed the maximum allowable grant amount outlined in Policy Announcement 24-03. If the ELRC has remaining available grant funds, they have the discretion to process/approve the Revised Budget and additional funding. In these cases, the ELRC will need to complete a Grant Agreement Amendment and send to the provider. The ELRC will release additional grant funding only after the Grant Agreement Amendment is signed and returned by the provider.

Providers who want to make adjustments across Budget Categories will not need to submit a Revised Budget unless they are requesting an increase in overall grant funding or to purchase an item(s) not included in their approved Requested Budget where the estimated cost of a single new line item exceeds $1,000 or more.

Example: Provider XYZ was approved for a grant. Their approved Requested Budget included $5,000 for Minor Renovations (Flooring, paint, drywall) and $3,000 for Indoor Health and Safety Equipment. During the grant period, the provider realizes that only $4,500 is needed for Minor Renovations but $3,500 is needed for Indoor Health and Safety Equipment (door locks, security cameras, etc.). The provider will not need to submit a Revised Budget as they are not requesting any additional funding and none of the single line items added to the Indoor Health and Safety Equipment category is estimated to cost $1,000 or more. Rather, the provider will report these changes on their Final Expense Report (FER).

Providers who wish to make minor adjustments within line items in a single Budget category will not need to submit a Revised Budget to the ELRC unless they are requesting additional grant funding or adding new line items(s) where the estimated cost of a single new line item exceeds $1,000.

Example #1: Program ABC was approved for a grant. Their approved Requested Budget includes a total of $10,000 in the Minor Renovations Budget Category with the following line items:

- $5,000 for new flooring,

- $3,000 for painting, and

- $2,000 for dry wall installation.

During the renovation process, the estimated costs change; painting costs decrease to $2,700 and dry wall installation costs increase to $2,300. Program ABC does not need to submit a Revised Budget to the ELRC as they are not requesting any additional grant funding nor are they adding any new line items where the estimated cost of a new line item exceeds $1,000. Instead, Program ABC will report the changes in the costs of line item(s) on their FER.

Eligible providers can use grant funds for eligible expenses in six grant categories. Examples of eligible expenses in each category are provided below, but do not reflect an exhaustive list. The exception is the sixth category (Personnel Costs) in which there are only three allowable expenses. Grant funds can be applied to eligible expenses incurred from July 1, 2024, to May 30, 2025.

Indoor Health and Safety Equipment

Outdoor Health and Safety Equipment

Minor Renovations*

*Major building construction or structural changes are not eligible expenses.

Materials and Equipment

Business Practice Purchases

Personnel Costs: – Limited to $5,000 per grant and limited to the following three expenses:

The Child Care Start Up and Expansion Grant cannot be used for any of the following expenses. Although the list is not exhaustive, the following is provided for general guidance.

Non-compliance with the requirements of the Child Care Start Up and Expansion Grant Agreement could result in the provider being required to return the Grant funds to their ELRC.

While providers will not submit receipts to the ELRC (unless requested), providers must keep original receipts for their records. These receipts may be reviewed by the ELRC, OCDEL Program Representatives, and/or state/federal agents for auditing/monitoring purposes. All Grant-related documentation must be maintained for seven years.

For monitoring purposes original receipts must have at a minimum:

*Family Child Care Homes or other providers that do not have a payroll will want to contact their ELRC to discuss potential options.

Receipts may exceed the total amount of funds issued with the understanding that the provider is responsible to pay for balances out of the program’s operating budget for amounts exceeding the Grant request.

The following is a listing of documents that are unallowable as a receipt or invoice:

*Family Child Care Homes or other providers that do not have a payroll will want to contact their ELRC to discuss options.

Providers issued an Award must submit a FER and return unspent Award funds to their ELRC by the deadline (June 13, 2025). Providers who fail to meet the requirements will be subject to the Dunning Cycle as detailed in Commonwealth Management Directive 310.10. OCDEL’s Dunning Cycle will consist of three letters informing providers of the spending and reporting requirements they agreed to in the Grant Agreement. Failure to respond to the Dunning Cycle will result in an additional letter informing providers of referral to OAG and if applicable, their Keystone STARS suspension. The OAG is statutorily authorized to collect delinquent debt for state agencies pursuant to 71 P.S. § 204(c).

Repayment plans may be offered by an ELRC if a provider must return Grant funds to the Commonwealth. If a provider agrees to a repayment plan with an ELRC and misses a regularly scheduled installment, the provider will forgo the Dunning Cycle and be referred to OAG for recoupment.